IELTS General Test – Passage 04: Maternity benefits reading with answers explanation, location and pdf. This reading paragraph has been taken from our huge collection of Academic & General Training (GT) Reading practice test PDFs.

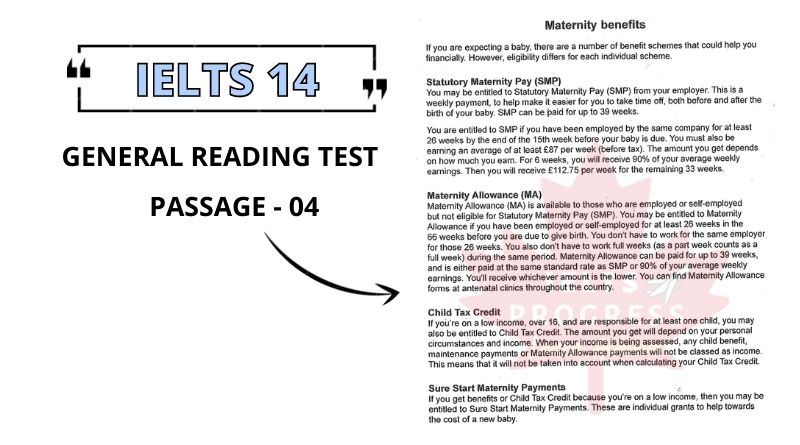

Maternity benefits

If you are expecting a baby, there are a number of benefit schemes that could help you financially. However, eligibility differs for each individual scheme.

Statutory Maternity Pay (SMP)

You may be entitled to Statutory Maternity Pay (SMP) from your employer. This is a weekly payment, to help make it easier for you to take time off, both before and after the birth of your baby. SMP can be paid for up to 39 weeks.

You are entitled to SMP if you have been employed by the same company for at least 26 weeks by the end of the 15th week before your baby is due. You must also be earning an average of at least £87 per week (before tax). The amount you get depends on how much you earn. For 6 weeks, you will receive 90% of your average weekly earnings. Then you will receive £112.75 per week for the remaining 33 weeks.

Maternity Allowance (MA)

Maternity Allowance (MA) is available to those who are employed or self-employed but not eligible for Statutory Maternity Pay (SMP). You may be entitled to Maternity Allowance if you have been employed or self-employed for at least 26 weeks in the 66 weeks before you are due to give birth. You don’t have to work for the same employer for those 26 weeks. You also don’t have to work full weeks (as a part week counts as a full week) during the same period. Maternity Allowance can be paid for up to 39 weeks, and is either paid at the same standard rate as SMP or 90% of your average weekly earnings. You’ll receive whichever amount is the lower. You can find Maternity Allowance forms at antenatal clinics throughout the country.

Child Tax Credit

If you’re on a low income, over 16, and are responsible for at least one child, you may also be entitled to Child Tax Credit. The amount you get will depend on your personal circumstances and income. When your income is being assessed, any child benefit, maintenance payments or Maternity Allowance payments will not be classed as income. This means that it will not be taken into account when calculating your Child Tax Credit.

Sure Start Maternity Payments

If you get benefits or Child Tax Credit because you’re on a low income, then you may be entitled to Sure Start Maternity Payments. These are individual grants to help towards the cost of a new baby.

Questions 21-27

Answer the questions below.

Choose NO MORE THAN TWO WORDS AND/OR A NUMBER from the text for each answer.

Write your answers in boxes 21-27 on your answer sheet.

21. What is the minimum period you must have worked for an employer in order to be eligible for SMP?

22. For how long is SMP payable every week as a percentage of your average weekly earnings?

23. What sum is payable every week as the second part of SMP entitlement?

24. What is the maximum length of time MA is payable?

25. Where can MA forms be obtained?

26. Apart from income, what else is considered when assessing how much Child Tax Credit is paid?

27. What are Sure Start Maternity Payments?

________________

ALSO TRY:

1) IELTS 14 READING PASSAGE – CABIN BAGS FOR AIR TRAVEL ↗

2) IELTS 14 READING PASSAGE – COLLEGE CAR PARKING POLICY ↗

3) IELTS 14 READING PASSAGE – TRANSITION CARE FOR THE ELDERLY ↗

4) IELTS 14 READING PASSAGE – PAPYRUS ↗

________________

Have any doubts??? Discuss in the comments ...

Answers with Explanation

Check out Maternity benefits reading answers below with explanations and locations given in the text.

21 26 weeks

22 6 weeks/ six weeks

23 £112.75

24 39 weeks

25 antenatal clinics

26 personal circumstances

27 grants

If you want the pdf summary of Maternity benefits reading passage and answers, please write your email in the comment section below. We’ll send it across at the speed of light.

ALL THE BEST !

mahadevan.manju@yahoo.com