IELTS Academic Test – Passage 07: Micro-Enterprise Credit for Street Youth reading with answers location, explanation and pdf summary.

Micro-Enterprise Credit for Street Youth

Introduction

Although small-scale business training and credit programs have become more common throughout the world, relatively little attention has been paid to the need to direct such opportunities to young people. Even less attention has been paid to children living on the street or in difficult circumstances.

Over the past nine years, Street Kids International (S.K.I.) has been working with partner organisations in Africa, Latin America and India to support the economic lives of street children. The purpose of this paper is to share some of the lessons S.K.I. and our partners have learned.

Background

Typically, children do not end up on the streets due to a single cause, but to a combination of factors: a dearth of adequately funded schools, the demand for income at home, family breakdown and violence. The street may be attractive to children as a place to find adventurous play and money. However, it is also a place where some children are exposed, with little or no protection, to exploitative employment, urban crime, and abuse.

Children who work on the streets are generally involved in unskilled, labour-intensive tasks which require long hours, such as shining shoes, carrying goods, guarding or washing cars, and informal tracing. Some may also earn income through begging, or through theft and illegal activities. At the same time, there are street children who take pride in supporting themselves and their families and who often enjoy their work. Many children may choose entrepreneurship because it allows them a degree of independence, is less exploitative than many forms of paid employment, and is flexible enough to allow them to participate in other activities such as education and domestic tasks.

Street Business Partnerships

S.K.I. has worked with partner organisations in Latin America, Africa and India to develop innovative opportunities for street children to earn income.

• The S.K.I. Bicycle Courler Service first started in the Sudan. Participants in this enterprise were supplied with bicycles, which they used to deliver parcels and messages, and which they were required to pay for gradually from their wages. A similar program was taken up in Bangalore, India.

• Another successful project, The Shoe Shine Collective, was a partnership program with the Y.W.C.A. in the Dominican Republic. In this project, participants were lent money to purchase shoe shine boxes. They were also given a sale place to store their equipment and facilities for individual savings plans.

• The Youth Skills Enterprise initiative in Zambia is a joint program with the Red Cross Society and the Y.W.C.A. Street youths are supported to start their own small business through business training, life skills training and access to credit.

Lessons learned

The following lessons have emerged from the programs that S.K.I. and partner organisations have created.

• Being an entrepreneur is not for everyone, nor for every street child. Ideally, potential participants will have been involved in the organisation’s programs for at least six months, and trust and relationship building will have already been established.

• The involvement of the participants has been essential to the development of relevant programs. When children have had a major role in determining procedures, they are more likely to abide by and enforce them.

• It is critical for all loans to be linked to training programs that include the development of basic business and life skills.

• There are tremendous advantages to involving parents or guardians in the program, where such relationships exits. Home visits allow staff the opportunity to know where the participants live, and to understand more about each individual’s situation.

• Small loans are provided initially for purchasing fixed assets such as bicycles, shoe shine kits and basic building materials for a market stall. As the entrepreneurs gain experience, the enterprises can be gradually expanded and consideration can be given to increasing loan amounts. The loan amounts in S.K.I. programs have generally ranged from US$90-$100.

• All S.K.I. programs have charged interest on the loans, primarily to get the entrepreneurs used to the concept of paying interest on borrowed money. Generally, the rates have been modest (lower than bank rates)

Conclusion

There is a need to recognise the importance of access to credit for impoverished young people seeking to fulfill economic needs. The provision of small loans to support the entrepreneurial dreams and ambitions of youth can be an effective means to help them change their lives. However, we believe that credit must be extended in association with other types of support that help participants develop critical skills as well as productive businesses.

Questions 1-4

Choose the correct letter, A, B, C or D. Write your answers in boxes 1-4 on your answer sheet.

1. The quotations in the box at the beginning of the article

A. exemplify the effects of S.K.I.

B. explain why S.K.I. was set up.

C. outline the problems of street children.

D. highlight the benefits to society of S.K.I.

2. The main purpose of S.K.I. is to

A. draw the attention of governments to the problem of street children.

B. provide schools and social support for street children.

C. encourage the public to give money to street children.

D. give business training and loans to street children.

3. Which of the following is mentioned by the writer as a reason why children end up living on the streets?

A. unemployment

B. war

C. poverty

D. crime

4. In order to become more independent, street children may

A. reject paid employment.

B. leave their families.

C. set up their own business.

D. employ other children.

________________

ALSO TRY:

1) IELTS 4 READING PASSAGE – WHAT DO WHALES FEEL? ↗

2) IELTS 4 READING PASSAGE – VISUAL SYMBOLS AND THE BLIND ↗

3) IELTS 4 READING PASSAGE – LOST FOR WORDS ↗

4) IELTS 4 READING PASSAGE – PLAY IS A SERIOUS BUSINESS ↗

________________

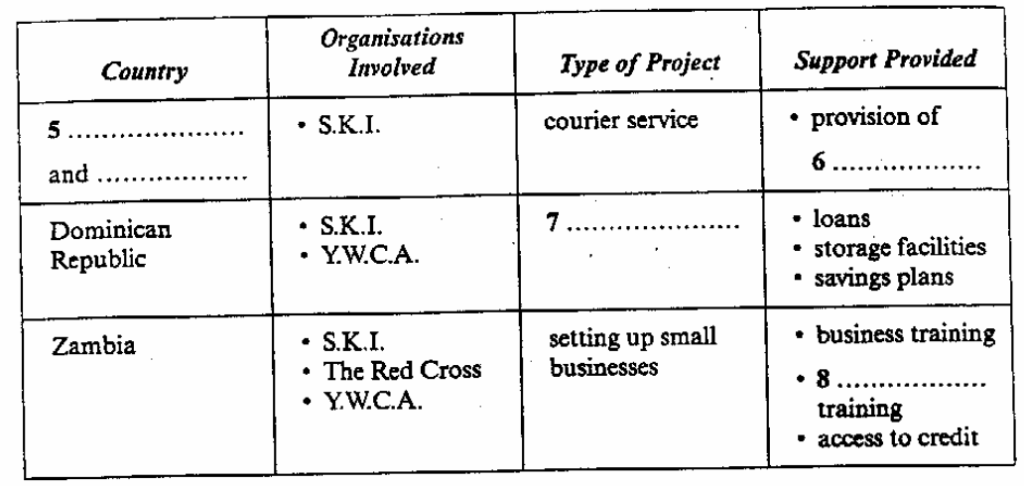

Questions 5-8

Complete the table below. Choose NO MORE THAN THREE WORDS from Reading Passage 7 for each answer.

Do the following statements agree with the claims of the writer in Reading Passage 7?

Write your answers in boxes 5-8 on your answer sheet.

Questions 9-12

In boxes 9-12 on your answer sheet write:

YES if the statement agrees with the claims of the writer

NO if the statement contradicts the claims of the writer

NOT GIVEN if it is impossible to say what the writer thinks about this

9. Any street child can set up their own small business if given enough support.

10. In some cases, the families of street children may need financial support from S.K.I.

11. Only one fixed loan should be given to each child.

12. The children have to pay back slightly more money than they borrowed.

Questions 13

Choose the correct letter, A, B, C or D. Write your answer in box 13 on your answer sheet.

The writers conclude that money should only be lent to street children

A as part of a wider program of aid.

B for programs that are not too ambitious.

C when programs are supported by local businesses.

D if the projects planned are realistic and useful.

Answers

Check out Micro-Enterprise Credit for Street Youth reading answers below with locations and explanations given in the text.

1 A

2 D

3 C

4 C

5 Sudan, India (In either Order)

6 bicycle

7 Shoe Shine/ Shoe Shine Collective

8 life skills

9 NO

10 NOT GIVEN

11 YES

12 YES

13 A

If you want the pdf summary of Micro-Enterprise Credit for Street Youth reading passage, please write your email in the comment section below. We’ll send it across at the speed of light.

Please send me pdf all 3 passages of the whole test 3. Thank you